-

Pick Your Field, Know Your Boundaries

Most people think trading is about doing more. More charts. More trades. More setups. But in my experience, that mindset leads to nothing but frustration, fatigue, and a confused account balance. The truth is, we don’t get paid to trade, we get paid to wait. And when the market gives us the right hand, we Read more

-

Keep It Simple: The Hidden Edge Most Traders Overlook

In trading, complexity is seductive. It feels like control, as if stacking more tools onto our charts somehow protects us from uncertainty. But the truth is, complexity often becomes a smokescreen. It disguises hesitation. It fragments our focus. And when real-time pressure hits, it tends to collapse under its own weight. Simplicity, by contrast, is Read more

-

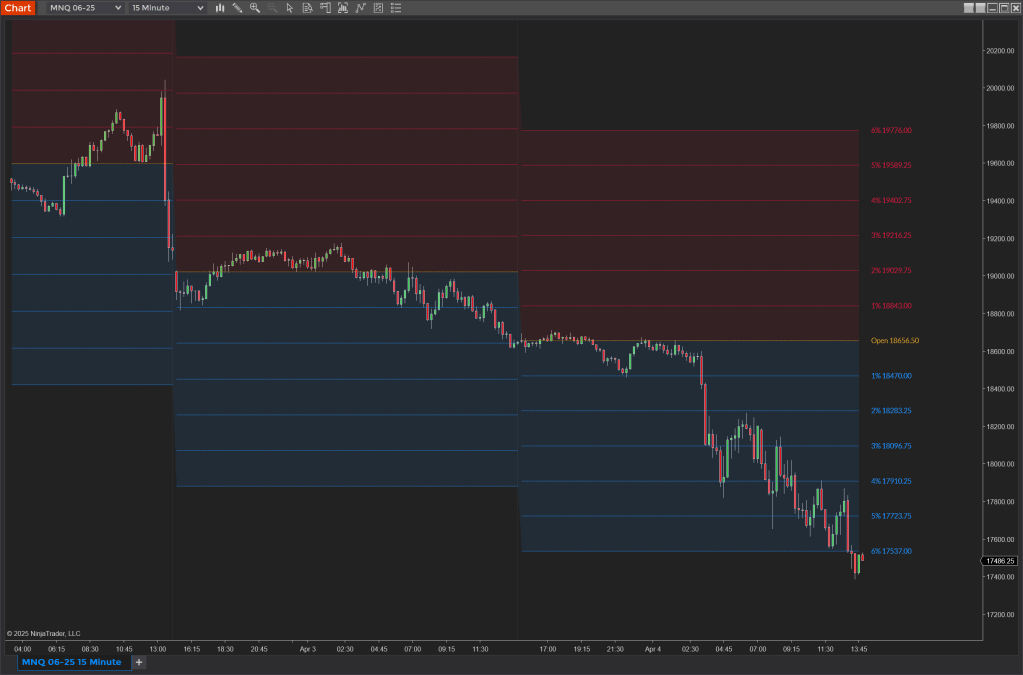

Navigating Big Moves with Precision: Understanding the Power of Percent-Based Pivots in Futures Day Trading

When you’re trading futures, you’re not just reacting to price, you’re making decisions in real time based on context. That’s what separates the professional from the casual participant. Every day brings new variables, but when you have a system that helps you quantify movement, you move from reacting emotionally to interpreting logically. And that’s where Read more

-

A Year-End Recap of Futures Markets

NQ 03-24 The average daily range spanned between 600 ticks on lower volatility days up to 1200 ticks on higher volatility days. The average daily volume spanned between 485K contracts exchanged on lower volatility days up to 775K on higher volatility days. When price is in a trend, and bars start to get smaller in Read more

-

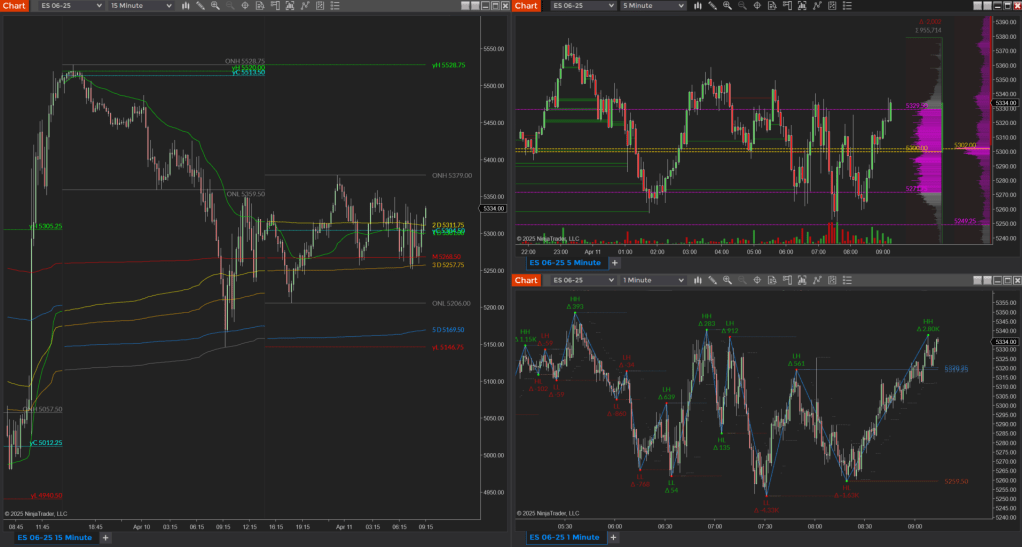

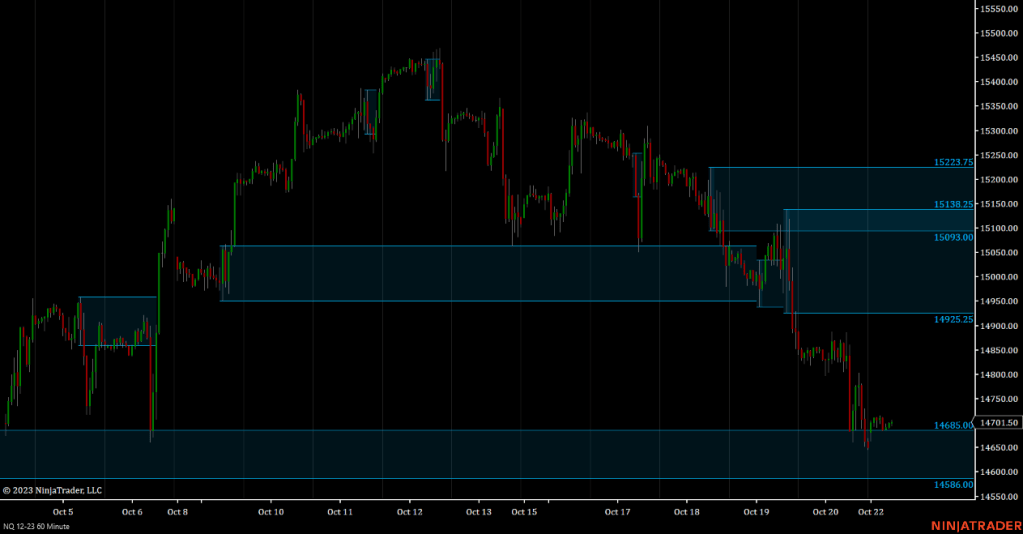

Mastering the Week Ahead – 10/23/2023

Analyzing NQ Futures Across Multiple Timeframes A picture is worth a thousand words, and when it comes to understanding price movements, a chart speaks volumes that mere text can’t capture. Key Indicators: Time-Frames: In trading, these charts and indicators are your visual guides. Use them to gain a quick yet comprehensive view of market dynamics. Read more

-

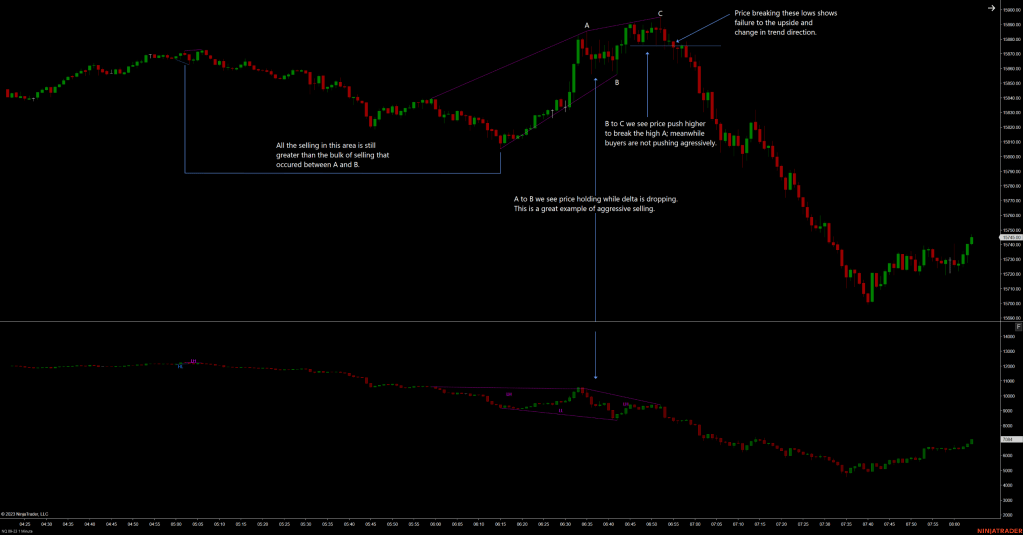

Delta Divergence – Set up and Price Action.

Today’s Emini-Nasdaq offered a great example of Delta Divergence creating a resistance zone as it accelerated into a support level at 15700. The example occurred on the 1-minute chart, which I’ve been using for my Volume Delta lately; however, the concept is applicable on all timeframes and markets given they offer suitable liquidity. Congestion is Read more

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.