Description

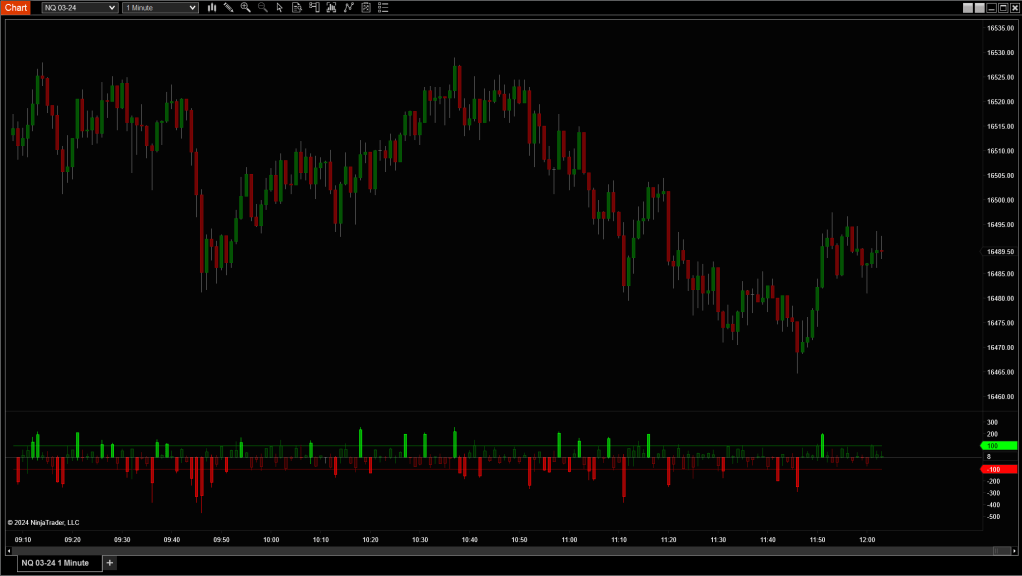

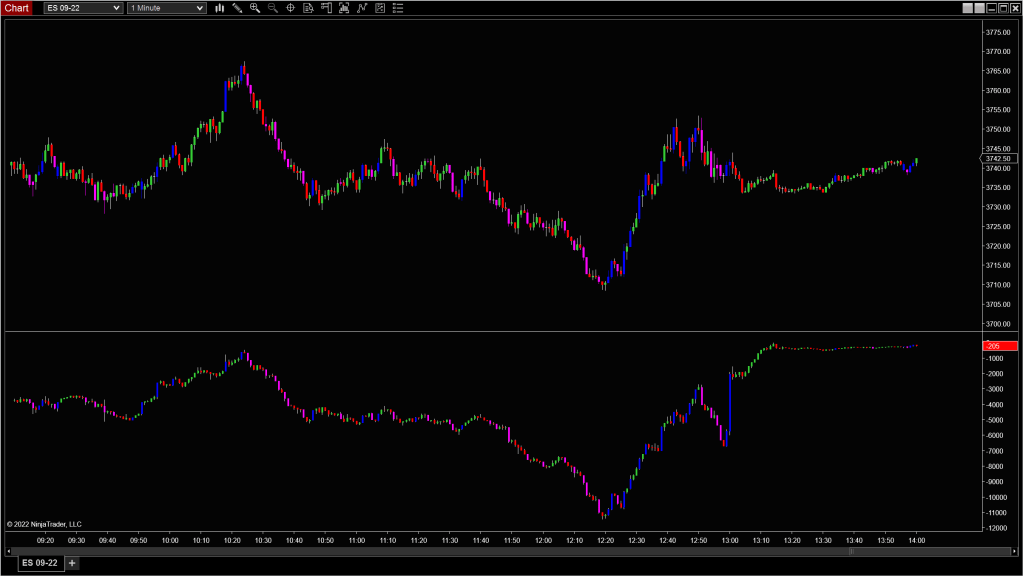

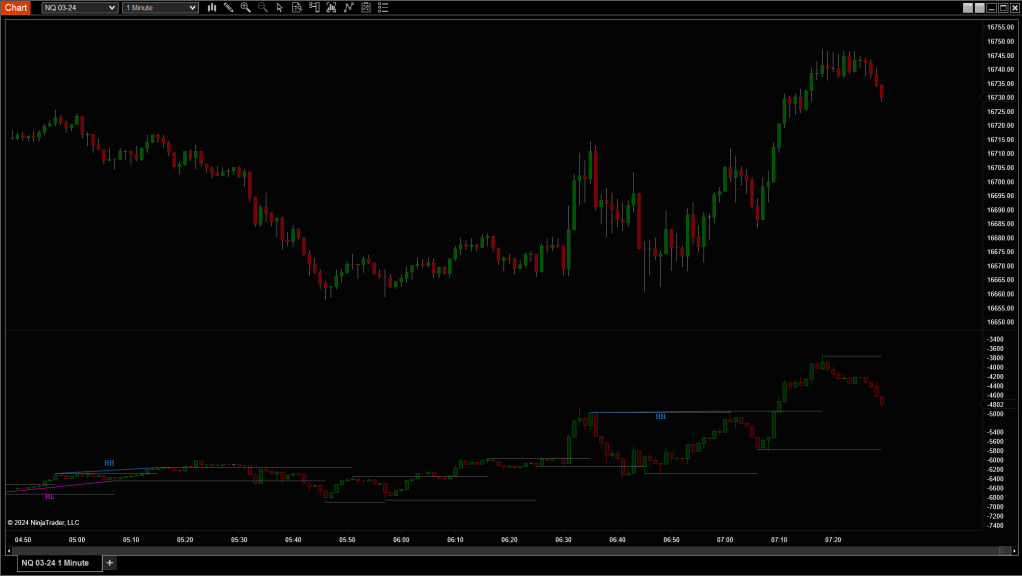

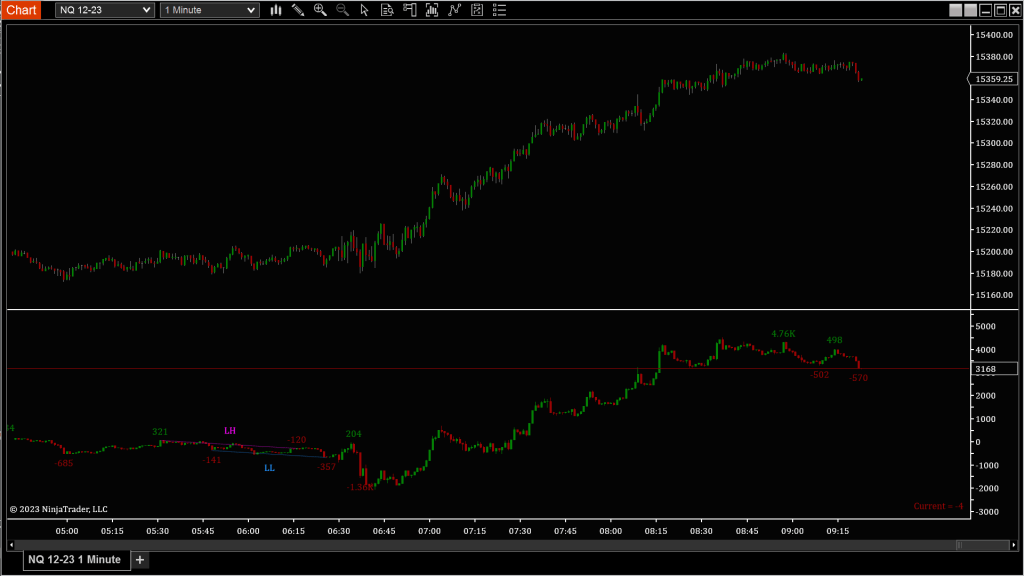

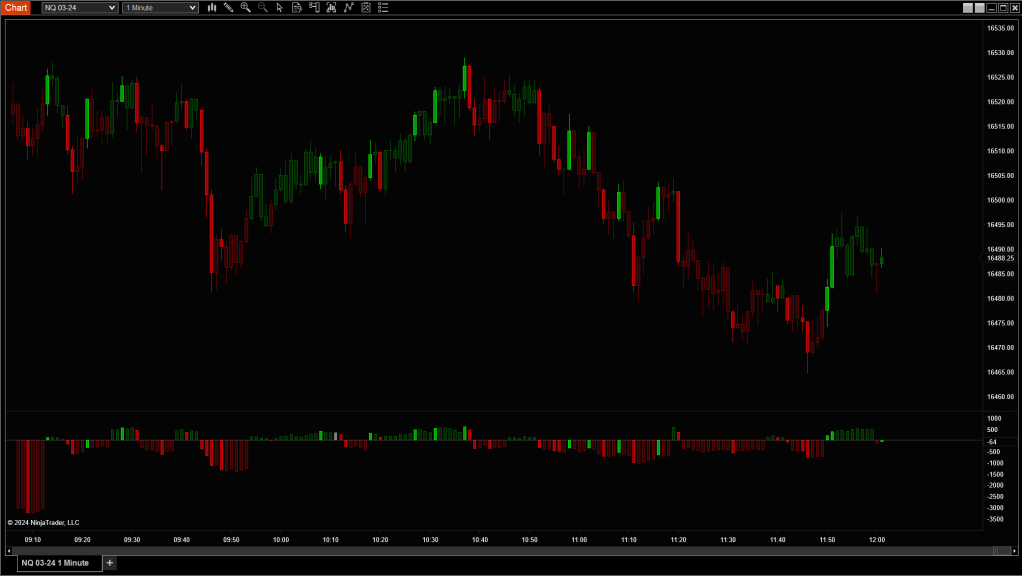

Volume Delta shows the battle between aggressive buyers and sellers. It measures the difference between buying and selling pressure, helping you spot imbalances that may not be visible on a price chart alone.

You can filter by session, swing, bar, or cumulative—and even narrow in on large trade sizes or divergence conditions.

Tip: When price pushes to a new high but delta is weak or negative, it often means there’s no real buyer commitment—watch for reversals or absorption.

In-Depth Volume Imbalance Analysis

Delta Type

- Cumulative: Rolls over session-to-session

- Session: Resets each session

- Bar: Resets each bar

- Swing: Resets at each market swing

Size Filter

Set a minimum trade size to include in delta readings

Match Bar Width

- True: Match candle width to price bar (gapped)

- False: Standard bar visuals

Filtering Options

Advanced delta-based signal generation:

- Divergence: Delta vs. price action

- High Delta: Spike in delta

- High Delta + Price Extension: Spike + wick in opposite direction

High Delta Threshold Calculation

- Average Range: Uses average delta range × multiplier

- Upper/Lower Bound: Manually define threshold