Most people think trading is about doing more. More charts. More trades. More setups. But in my experience, that mindset leads to nothing but frustration, fatigue, and a confused account balance.

The truth is, we don’t get paid to trade, we get paid to wait. And when the market gives us the right hand, we play it with size and confidence. Everything else? That’s just noise.

Not Every Environment Is Yours

There’s always a market open. Always something moving. That doesn’t mean it’s your move to take.

Let’s be real: most of what happens intraday is just random price slop. It looks like opportunity, but it’s not structured, it’s not clean, and it doesn’t offer favorable odds. If you find yourself trying to force trades, stretching your edge to fit what the market is doing, you’re on the wrong playing field.

You need to define what your ideal field looks like. Tighten your criteria. Get selective.

For me, I trade when structure aligns with intent. If price is moving between key levels I’ve already mapped out, if delta confirms that buyers or sellers are committed, if volatility is balanced, not explosive, I’ll engage. If not? I wait.

Draw a Box Around What You Don’t Trade

Here’s something that took me years to learn: sitting out is a skill.

Just like athletes know the boundaries of the field, you need to know your “No Play Zone.” These are environments where your edge disappears, sloppy price action, overlapping candles, erratic volume, low conviction.

Recognize that not trading is a choice. It’s not fear. It’s not hesitation. It’s professionalism. It’s protecting your capital and your focus so that when the conditions are right, you’re sharp, confident, and ready.

You can even mark these zones visually. For example, I box out areas on my charts where the market is stuck in tight, overlapping range, or where the day opens in the middle of prior value and just grinds. These are places where your tools might still fire off signals, but context tells you to ignore them.

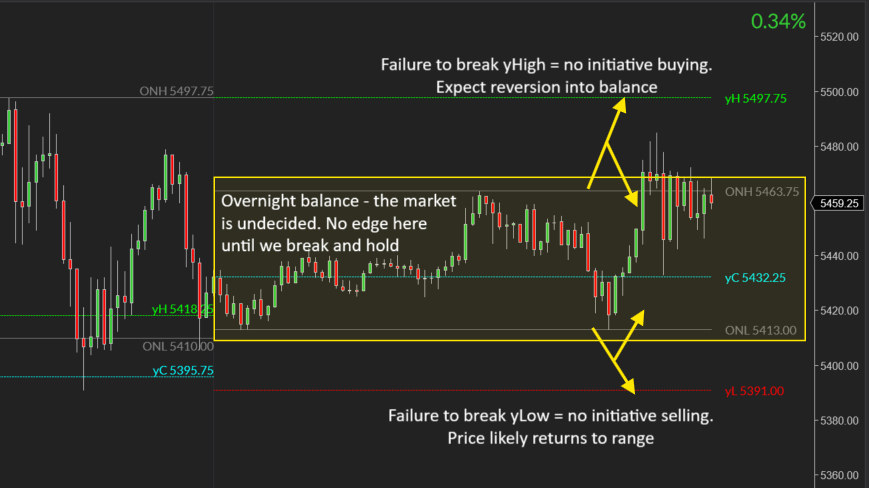

Visualizing Balance and “No Play” Zones

When you hear “balance,” it’s easy to think of it as a concept, something abstract. But balance leaves footprints. And when you learn to see them, you’ll recognize when your edge is absent and patience is required.

Here are two examples from recent ES price action.

Price opened within the prior day’s high and low, a clear signal that we’re starting the session from a position of higher timeframe balance. We’re not at the edges. We’re not breaking structure. We’re sitting right in the middle, waiting for initiative traders to step in.

The early push toward yesterday’s high was met with exhaustion. No buyers willing to accept price higher. When that happens, price often rotates back into the range, not because it has to, but because that’s where the market is still finding value.

The same story played out on the downside. Sellers couldn’t drive below yesterday’s low. No follow-through, no breakdown. Just more balance.

This is the type of structure I call a “No Play Zone.” It’s not indecision on your part, it’s the market showing you that it hasn’t made up its mind yet. Until it does, you’re better off waiting.

This second chart shows the same concept on a tighter scale, the prior day’s value area.

Most of yesterday’s trading volume occurred inside this yellow box. That’s where the market agreed on price. So when today’s session opens and price tries to break above or below that zone, we watch closely: is the market ready to auction somewhere new?

Turns out it wasn’t. Early breakout attempts were weak. No acceleration. No interest. Both the highs and lows of the value area acted like magnets, pulling price back in.

This is microstructure doing its job. This is what it looks like when the market says, “We’re not done here yet.”

When you see this, when you see failure to expand beyond value, you don’t need to guess. You wait. Because now you understand: balance is visible, and edge only exists when price shows intent.

Wait for the Market to Step Into Your Arena

You’re not here to fight every battle. You’re here to wait for the ones that are already tilted in your favor.

That’s the mindset shift: You’re not chasing opportunity. You’re letting the market come to you. The playing field you’ve defined? That’s your turf. Let the market come onto it. When it does, strike.

Until then? There’s no shame in standing down.