In trading, complexity is seductive. It feels like control, as if stacking more tools onto our charts somehow protects us from uncertainty. But the truth is, complexity often becomes a smokescreen. It disguises hesitation. It fragments our focus. And when real-time pressure hits, it tends to collapse under its own weight.

Simplicity, by contrast, is powerful. Not because it’s easy, but because it clears a path toward clarity, decisiveness, and consistency, all traits that separate professionals from hopefuls.

That clarity begins with a shift in mindset. You stop asking “What else can I add?” and start asking “What’s essential to make an informed decision?”

Complexity Can Feed the Ego. Simplicity Serves the Execution.

Most traders overcomplicate because they don’t trust themselves yet. They want one more indicator to confirm the obvious. They second-guess because their strategy isn’t well-defined or their execution rules aren’t internalized. I’ve been there.

But trading doesn’t reward analysis paralysis. It rewards preparation, context, and the ability to act without hesitation when the moment arrives.

Simplicity doesn’t mean stripping your chart to just candlesticks. It means refining what you use, and knowing why you’re using it.

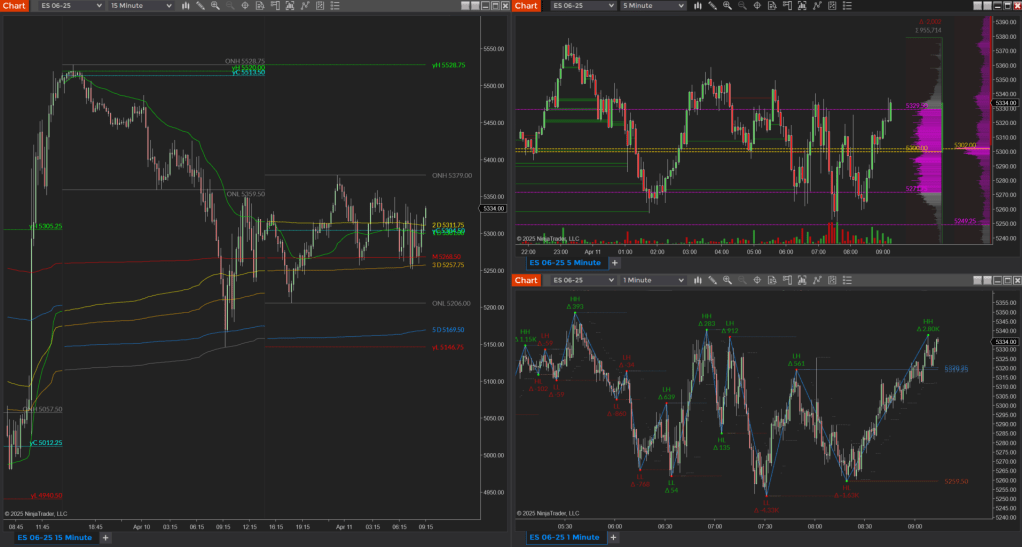

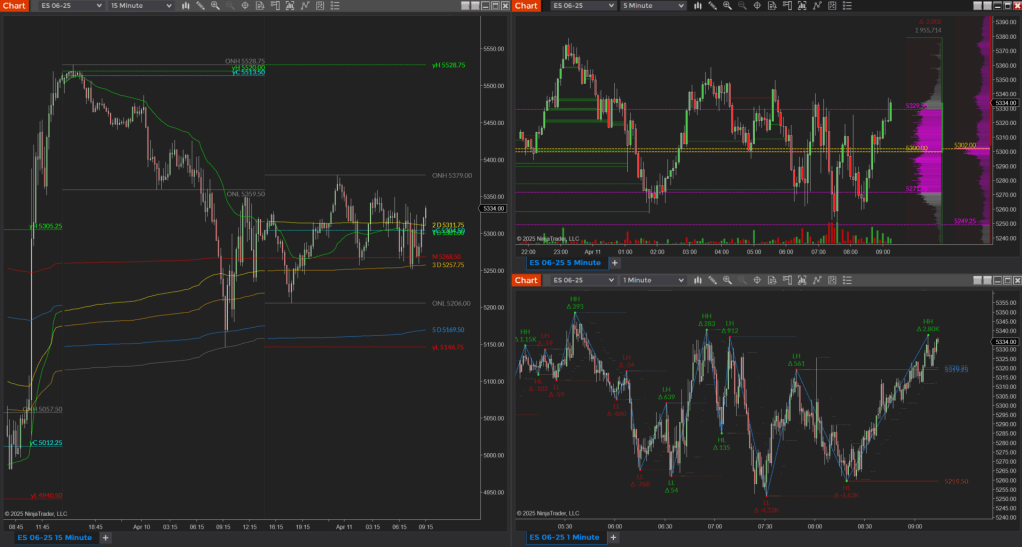

In my own workflow, I don’t operate on blank charts. I use Daily Levels and MultiDay VWAP on a 15-min chart, Volume Imbalance on a 5-min chart, and the Ultimate ZigZag on a 1-min chart. But each chart has a clear purpose, and each tool has been stress-tested through experience.

This isn’t about dogma, it’s about precision.

Simplicity Requires Depth

Simplicity doesn’t mean doing less thinking. It means thinking more clearly.

When your chart is clean, your mind is clear. You can focus on what really matters:

- Are we trending or balanced?

- Where is value forming or shifting?

- Who’s in control, and what would signal they’ve lost it?

- Where might pain points trigger forced action?

You don’t need a dozen indicators to answer these. You need structure. You need behavioral context. You need to ask better questions, the kind that focus on what the market is trying to do and whether it’s succeeding or failing.

That’s what I look for every day. The structure. The context. The pressure points.

The deeper your understanding of those elements, the fewer tools you’ll need to see opportunity.

The Edge Is in Clarity, Not Complexity

Traders often ask, “What’s your edge?” expecting a unique setup or some proprietary signal. But more often than not, the real edge is clarity. It’s the ability to recognize alignment between context, structure, and behavior, and to act on it without hesitation.

That kind of edge doesn’t come from loading up more indicators. It comes from deeply understanding the tools you already use, and knowing exactly when to engage or step aside.

In my experience, one well-placed imbalance zone, one clearly broken swing level, or one shift in Value Area positioning, when combined with the day’s broader structure, can offer more than enough information to take a decisive trade. The rest just gets in the way.

Practical Takeaways

Here are a few reminders I return to often, and ones I recommend to anyone refining their process:

- Start with context

Before anything else, identify where we are relative to prior value, key levels, and trend structure. - Observe behavior

Look for signs of initiative vs. responsive action. Who’s stepping in, and how is price reacting? - Use your tools intentionally

If it’s on your chart, it needs a purpose. Don’t add indicators unless you can articulate exactly what they provide that price alone can’t. - Wait for alignment

Don’t force trades. When structure, bias, and behavior align, you’ll know. Your job is to act with confidence, not hope. - Focus on execution, not perfection

One clean, well-planned trade is worth far more than five rushed ones. Simplicity helps you focus on process, and process is where consistency lives.

Final Thoughts

Simplicity in trading is not about minimalism, it’s about refinement. It’s the result of editing down to what works, knowing when to act, and removing everything that clouds judgment.

When your tools are intentional and your mind is focused, you gain the space to trade with clarity. That’s where the real edge is.

So keep it simple, not because it’s trendy, but because it sharpens your edge and strengthens your discipline. And in this game, that’s what gets paid.